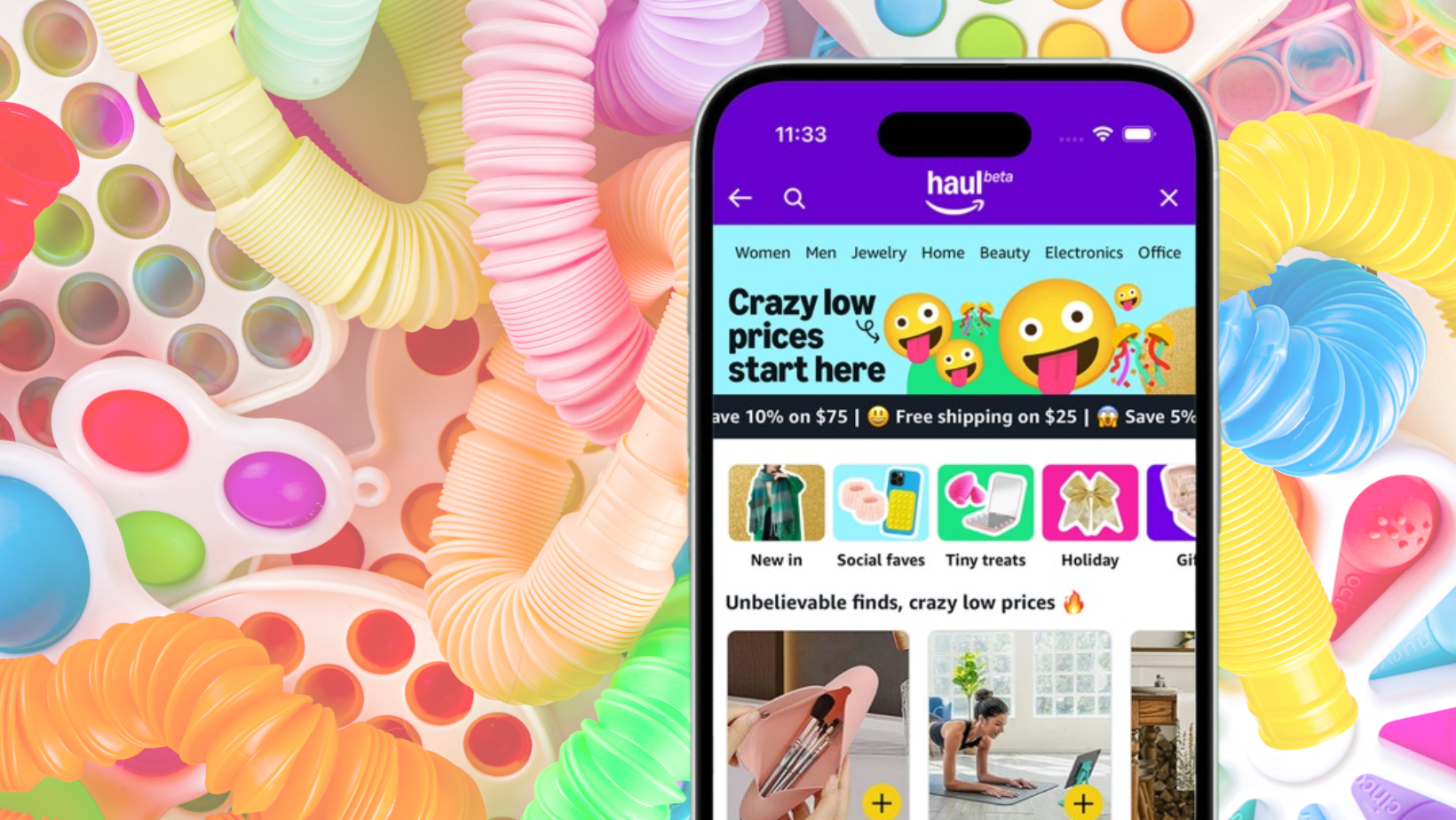

When Amazon quietly launched its Haul beta in 2024, it felt like the most radical rethink of the Amazon shopping experience in years. Moving away from search-driven browsing and bullet-point listings, Haul promised a curated, visual, and impulse-friendly shopping flow designed to compete directly with social-commerce giants like Temu and TikTok Shop.

A year later, sellers and analysts alike are asking the same question: Is Amazon Haul succeeding in the marketplace — or is it still finding its footing?

The Original Promise: Discovery Over Search

At launch, Amazon Haul represented more than just a new feature. It was a strategic pivot in how Amazon envisioned product discovery and conversion. Rather than relying on shoppers to type in keywords and compare dozens of standalone listings, Haul introduced curated product collections — “hauls” — built around specific use cases, lifestyles, or seasonal moments.

It also rewrote the rules for product pages. Gone were the long descriptions, dense bullet points, and endless review scrolls. Instead, shorter, image-driven PDPs took center stage, optimized for mobile and designed for split-second decision-making. Checkout even lived in a self-contained flow, separate from the traditional Amazon cart — signaling the platform’s interest in more impulse-driven, bundled purchasing.

In short, Haul was Amazon’s bid to capture a new kind of shopper: one who browses and buys based on trends and curated storytelling, not just search intent.

Early Signs of Traction: Engagement and AOV

While Amazon has shared little publicly about Haul’s performance, early indicators suggest steady, if measured traction. Industry watchers report that featured collections are expanding across categories like beauty, kitchen essentials, and seasonal décor. The curated approach appears to be resonating with certain audiences — particularly younger shoppers accustomed to social-commerce feeds.

The most promising signal? Sellers featured in Haul collections report higher average order values (AOV), often because shoppers add multiple complementary products in one click. This bundling behavior is precisely what Amazon hoped to spark — and could have significant implications for seller revenue and marketplace dynamics.

Engagement metrics, too, show potential. The visual, swipe-friendly experience seems to increase time on page, and anecdotal reports suggest stronger conversion rates for impulse-priced items under $20. Amazon hasn’t released data, but the anecdotal momentum is enough to signal that Haul is more than a passing experiment.

Seller Sentiment: Optimism Meets Frustration

On the seller side, Haul’s first year has been a mixed bag. Those featured in curated collections often see meaningful traffic spikes and revenue lifts — especially for newer or lesser-reviewed products that might otherwise struggle in traditional search results. The reduced emphasis on review count and keyword dominance levels the playing field, giving smaller brands a rare visibility boost.

But there’s also frustration. Because Haul remains a closed beta, most sellers cannot opt in or apply to participate. Inclusion criteria are opaque, though price point, sales velocity, and strong visual assets appear to matter most. That lack of transparency leaves many sellers unsure how to prepare their catalogs or optimize their listings to increase their chances of being featured.

Additionally, while the streamlined PDPs benefit mobile conversions, some brands feel constrained by the limited storytelling space. Without long descriptions or robust review sections, differentiating premium products from budget alternatives can be harder — a tension Amazon will likely need to address as Haul evolves.

Why Is Amazon Haul Still in Beta?

A year after launch, one of the most common questions from sellers is why Haul remains in beta. The answer is less about hesitation and more about Amazon’s strategic patience. Haul isn’t just a new feature — it’s a potential reimagining of how shopping happens on the platform. Amazon is moving slowly for several key reasons:

Testing Shopper Behavior: Haul represents a fundamental shift from search-based to discovery-driven shopping. Amazon wants deep insights into how shoppers interact with curated collections, simplified PDPs, and one-click bundle checkout before scaling globally.

Refining Product Selection: Current inclusion appears based on factors like price point, visual appeal, fulfillment speed, and sales velocity. Keeping Haul small allows Amazon to fine-tune its curation logic and ensure featured products deliver consistently high conversion.

Infrastructure Evolution: Because Haul operates with a separate checkout flow, Amazon is still refining how it integrates with Prime shipping, Subscribe & Save, ad placements, and promotions.

Proof Before Scale: Amazon historically keeps features in beta until they prove they can reliably lift conversion, AOV, seller participation, and repeat purchases. Haul is no exception.

Part of a Larger Vision: Finally, Haul likely represents the first layer of a broader push into social commerce, AI-driven personalization, and creator-led shopping experiences. Amazon appears intent on building that ecosystem piece by piece.

In short, Amazon isn’t dragging its feet — it’s stress-testing the foundations of a new shopping model. A slow rollout gives it the flexibility to refine and adapt without disrupting its core marketplace.

Competitive Landscape: Haul vs. TikTok Shop and Temu

It’s impossible to evaluate Amazon Haul without comparing it to the platforms that inspired it. TikTok Shop continues to surge, converting discovery directly into purchase within creator-led videos. Temu, meanwhile, has weaponized ultra-low pricing and addictive app design to capture massive Gen Z attention.

Haul hasn’t matched either platform’s growth curve — but that may not be the point. Instead, Amazon appears to be layering a social-commerce-style experience into its existing ecosystem rather than trying to rebuild it from scratch. That approach could give Haul staying power, allowing Amazon to blend the best of traditional marketplace infrastructure (Prime shipping, fulfillment, trust) with the fresh, curated feel consumers now expect.

What Sellers Should Do Now

Even if Haul hasn’t fully rolled out, sellers can act now to prepare for a broader launch. Based on what we know today, success in Haul depends on four key areas:

Visuals First: High-impact imagery and lifestyle photography matter more than ever. Your hero image now does much of the selling.

Clear, Benefits-Driven Titles: With fewer words on the page, titles must carry more weight. Focus on outcomes and use cases, not just features.

Impulse-Ready Pricing: Most featured products sit below $20. Review your catalog for SKUs that fit that profile or can be bundled to hit it.

Complementary Bundles: Think in themes — how can your products anchor a “haul” collection around a lifestyle or seasonal need?

Proactively aligning with these trends now will help you surface more naturally when Haul expands beyond closed beta.

Verdict: A Work in Progress With Serious Potential

So, is Amazon Haul succeeding? The honest answer is yes — but quietly. It hasn’t exploded into the mainstream yet, nor has it been positioned as a flagship Amazon feature. But its steady rollout, promising engagement signals, and early seller wins suggest Amazon is committed to the experiment.

More importantly, Haul represents a strategic shift that aligns with where e-commerce is heading. As shopping becomes more visual, social, and discovery-led, Amazon is adapting its marketplace to match — and doing so in a way that plays to its existing strengths.

For sellers, the takeaway is clear: Haul isn’t just a feature to watch — it’s a glimpse into the future of Amazon itself. Those who prepare now will be best positioned to capitalize when Haul inevitably scales beyond beta and becomes a mainstream shopping destination.